Real-time Payments RTP Reject Codes

TodayPayments.com is the only payment platform that combines real-time transaction execution with intelligent reject resolution, AR aging, and bounce recovery—across FedNow®, RTP®, FedWire®, and Same-Day ACH. For businesses that can’t afford delay, error, or silence, we bring payment certainty, even when the rails push back.

Our mission is to empower businesses with the speed of real-time payments and the resilience to handle rejections. Through intelligent automation, ISO 20022 support, and seamless reconciliation tools, TodayPayments.com ensures that every transaction—success or failure—leads to forward momentum.

Understanding RTP® Reject Codes and ISO 20022 Bounce Messaging

When Real-Time Payments “Bounce,” Your AR

Shouldn’t Break

When Real-Time Payments “Bounce,” Your AR

Shouldn’t Break

In the world of real-time payments,

speed is everything—but certainty matters just as much. While

networks like FedNow®, RTP®, and FedWire® offer

blazing-fast transaction capabilities, some payments still fail

or get rejected due to formatting errors, account issues, or

compliance mismatches. These "bounces" are reported back using

ISO 20022 reject codes—and understanding them is key to avoiding

delays and reconciling fast.

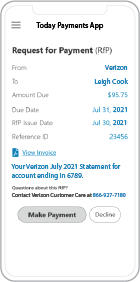

That’s where TodayPayments.com comes in. With full support for AR aging, bounce resolution, and Request for Payment (RfP) corrections, your business stays in sync, even when the transaction doesn’t.

Every rejected real-time transaction tells a story—and it speaks in the language of ISO 20022. These standard reject codes describe exactly why a payment failed:

- AC01: Invalid account number

- AM09: Payment amount exceeds limit

- BE05: Unknown beneficiary

- FF01: Formatting error in remittance

- RC01: Account closed or frozen

- ...and many more

These codes are returned instantly when a transaction is denied, helping you act fast and correct the issue before payment cycles stall.

With TodayPayments.com, you gain direct visibility into each reject type and access automated correction tools that reformat, reroute, or flag issues before they occur.

What to Do When Real-Time Payments Bounce Back

Rejected RTP® or FedNow® payments can happen for a number of reasons:

- Incorrect account or routing number

- Beneficiary mismatch

- Unsupported bank

- Over-limit transaction

- RfP request format not compliant with ISO 20022

Some bounces are fixable, some are fatal. With TodayPayments' tools, you can automatically:

- Flag retry-eligible transactions

- Re-format files in .XML, .CSV, or .JSON

- Route using alternative alias (email, phone)

- Apply real-time AR aging logic to monitor and reschedule retries

- Send a new RfP with corrected metadata

You don’t have to manually chase payment resolution anymore. Our smart workflows keep your receivables moving forward.

FedNow®, RTP®, FedWire®: Real-Time A2A with Built-In Reconciliation

✅ "FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

To support merchants and finance teams of all sizes, TodayPayments.com offers free downloadable templates, including:

- Aging Accounts Receivable Worksheet: Pre-built with 15, 30, 60, 90+ day tracking

- Bank Reconciliation Templates: Instantly match payments with deposits across batches

- ISO 20022 File Format Samples: Plug-and-play structures for batch uploads and RfP message testing

Whether you're sending a single A2A payment or a batch of thousands, TodayPayments connects your business to:

- FedNow® for 24/7 instant credit push

- RTP® Network for real-time RfP payments with bounce resolution

- FedWire® for high-value interbank transactions

- Same-Day ACH for batch payments with end-of-day confirmation

Our system doesn't just send money—it confirms it, reconciles it, and reacts to it.

Add your accounting software (like QuickBooks®) or use our standalone reconciliation platform. Either way, your rejected and accepted transactions get automatically logged, coded, and resolved.

Monitoring FedNow and Real-Time Payments (RTP) reject codes for Payers and Payees in the context of "Request for Payments" involves tracking and resolving transaction rejections efficiently. Here's a detailed guide on managing reject codes for both Payers and Payees:

1. Organize Your Spreadsheet:

- Create separate sheets or tabs for FedNow and RTP transactions, distinguishing between Payers and Payees.

- Include columns for transaction details, such as transaction ID, payment reference, amount, payer/payee details, and status.

2. Transaction Details:

- Include relevant details specific to FedNow and RTP transactions, such as FedNow transaction ID or RTP reference number.

3. Reject Code Column:

- Add a dedicated column to record the reject code associated with each transaction.

- Include an additional column for reject code descriptions to provide more context.

4. Status Indicators:

- Use status indicators to denote the current state of each transaction (e.g., Pending, Rejected, Resolved).

- Utilize color-coded flags or symbols for quick visual identification.

5. Automatic Date Calculations:

- Utilize formulas to automatically calculate the aging of rejected transactions based on the current date.

6. Conditional Formatting:

- Implement conditional formatting to visually highlight rejected transactions and aging categories.

- Distinguish between Payers and Payees using different colors or formatting.

7. Immediate Notification:

- Set up immediate notifications to receive alerts when reject codes are received from FedNow or RTP.

- Establish clear communication channels to ensure that relevant stakeholders are informed promptly.

8. Analysis of Reject Codes:

- Analyze each reject code to understand the specific reason for rejection.

- Consult the documentation provided by FedNow and RTP to interpret the reject codes accurately.

9. Error Resolution Workflow:

- Develop a standardized workflow for handling rejected transactions. This workflow should include:

- Investigation: Assign responsibilities to team members to investigate the details of the rejection.

- Correction: Correct the issues identified in the transaction that led to rejection.

- Resubmission: If applicable, prepare the corrected data for resubmission to FedNow or RTP.

10. Communication with Banks:

- Establish clear communication channels with banks to resolve issues related to reject codes.

- Seek additional information or clarification from banks if needed to address the rejection reasons effectively.

11. Data Cleaning Process:

- Initiate a data cleaning process to address issues identified by reject codes. This may involve correcting data entries, updating information, or resolving discrepancies.

12. Syncing with QuickBooks Online:

- Set up a systematic process for syncing your spreadsheet data with QuickBooks Online.

- Leverage QBO import tools or APIs to ensure accurate and timely data transfer.

13. Regular Reviews:

- Schedule periodic reviews to catch any discrepancies, errors, or overdue rejected transactions.

- Verify that aging categories are updated accurately based on the current date.

14. Documentation and Audit Trail:

- Document all actions taken to resolve reject codes, including corrections made to the data.

- Maintain an audit trail to track changes and provide transparency in case of future inquiries or audits.

15. Training and Awareness:

- Train relevant team members on the procedures for handling reject codes and cleaning data.

- Foster awareness of the importance of data accuracy and compliance with banking and transaction standards.

By implementing these steps, you can establish a comprehensive and well-organized process for monitoring FedNow and RTP reject codes for both Payers and Payees in Excel and Google Sheets. Regular reviews, documentation, and training are essential for maintaining accuracy and efficiency in your financial processes.

Fix Bounced Payments. Reconcile Like a Pro. Get Paid Faster.

Real-time payments move fast—but rejections don’t have to slow you down.

With TodayPayments.com, you can:

✅ Decode and act on

RTP® reject codes in real time

✅ Use

AR aging automation to reschedule or re-send

✅

Manage FedNow®, RTP®, and FedWire® transactions with

clarity

✅ Trigger Request for Payments

(RfP) that actually get paid

✅ Plug into

your favorite accounting platform for full-cycle

reconciliation

🟢 Get real-time speed

with real-time smarts.

👉 Visit

https://www.TodayPayments.com to transform how you

handle every payment—even the rejected ones.

ACH and both FedNow Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions.

The versions that

NACHA and

The Clearing House Real-Time Payments system for the Response to the Request are pain.013 and pain.014

respectively. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP® and FedNow ® versions are "Credit

Push Payments" instead of "Debit Pull.".

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.