QuickBooks® Request for Payment Invoicing

The Best Solution for Payment Processing in QuickBooks®

Today Payments is an Authorized Reseller of Intuit offering a highly robust app that supports both QuickBooks’ desktop and online customers, provide merchants with the tools they need so they can focus more time on their customers and businesses, and less time on data entry. "Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"

"Our Integrated payment solutions can save a typical small business owner more than 180 hours each year"See

the features

QuickBooks® ACH, Cards, FedNow and Real-Time Payments

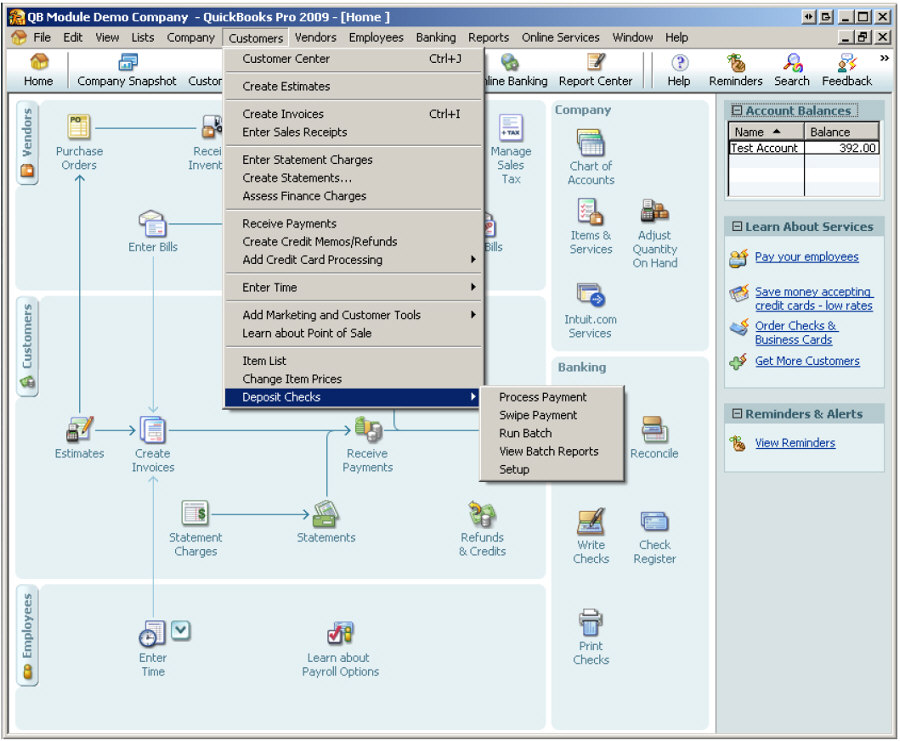

- Payment processing for all QuickBooks desktop, Pro, Premier, Enterprise and also QBO QuickBooks Online Our software is designed for simplicity and ease-of-use.

- ~ Automate Account Receivable Collection

- ~ Automate Account Payable Payments

- ~ One-time and Recurring Debits / Credits

Secure QB Plugin payment processing through QuickBooks ® specializes in the origination of moving money electronically.

Ask about our special:

Request for Payments

Monitoring FedNow and Real-Time Payments

(RTP) reject codes in spreadsheets like Excel and Google Sheets for

Request for Payments (RfP) transactions involves setting up a structured

process to identify, analyze, and address payment rejections. Here's a

guide on how you can manage reject codes for both Payers and Payees:

1. Organize Your Spreadsheet:

- Create separate sheets or tabs for

FedNow and RTP transactions, distinguishing between Payers and

Payees.

- Include columns for transaction details,

such as transaction ID, payment reference, amount, payer/payee

details, and status.

2. Transaction Details:

- Include relevant details specific to

FedNow and RTP transactions, such as FedNow transaction ID or RTP

reference number.

3. Reject Code Column:

- Add a dedicated column to record the

reject code associated with each transaction.

- Include an additional column for reject

code descriptions to provide more context.

4. Status Indicators:

- Use status indicators to denote the

current state of each transaction (e.g., Pending, Rejected,

Resolved).

- Utilize color-coded flags or symbols for

quick visual identification.

5. Automatic Date Calculations:

- Utilize formulas to automatically

calculate the aging of rejected transactions based on the current

date.

6. Conditional Formatting:

- Implement conditional formatting to

visually highlight rejected transactions and aging categories.

- Distinguish between Payers and Payees

using different colors or formatting.

7. Immediate Notification:

- Set up immediate notifications to

receive alerts when reject codes are received from FedNow or RTP.

- Establish clear communication channels

to ensure that relevant stakeholders are informed promptly.

8. Analysis of Reject Codes:

- Analyze each reject code to understand

the specific reason for rejection.

- Consult the documentation provided by

FedNow and RTP to interpret the reject codes accurately.

9. Error Resolution Workflow:

- Develop a standardized workflow for

handling rejected transactions. This workflow should include:

- Investigation: Assign

responsibilities to team members to investigate the details of

the rejection.

- Correction: Correct the issues

identified in the transaction that led to rejection.

- Resubmission: If applicable, prepare

the corrected data for resubmission to FedNow or RTP.

10. Communication with Banks:

- Establish clear communication channels

with banks to resolve issues related to reject codes.

- Seek additional information or

clarification from banks if needed to address the rejection reasons

effectively.

11. Data Cleaning Process:

- Initiate a data cleaning process to

address issues identified by reject codes. This may involve

correcting data entries, updating information, or resolving

discrepancies.

12. Syncing with QuickBooks Online:

- Set up a systematic process for syncing

your spreadsheet data with QuickBooks Online.

- Leverage QBO import tools or APIs to

ensure accurate and timely data transfer.

13. Regular Reviews:

- Schedule periodic reviews to catch any

discrepancies, errors, or overdue rejected transactions.

- Verify that aging categories are updated

accurately based on the current date.

14. Documentation and Audit Trail:

- Document all actions taken to resolve

reject codes, including corrections made to the data.

- Maintain an audit trail to track changes

and provide transparency in case of future inquiries or audits.

15. Training and Awareness:

- Train relevant team members on the

procedures for handling reject codes and cleaning data.

- Foster awareness of the importance of

data accuracy and compliance with banking and transaction standards.

By implementing these steps, you can

establish a comprehensive and well-organized process for monitoring

FedNow and RTP reject codes in Excel and Google Sheets for both Payers

and Payees. Regular reviews, documentation, and training are essential

for maintaining accuracy and efficiency in your financial processes.

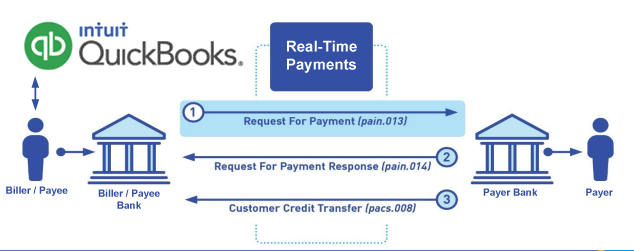

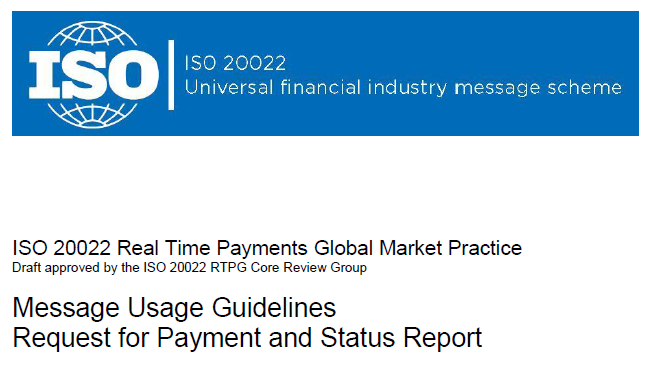

Call us, the .csv and or .xml Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) show how to implement Create Real-Time Payments Request for Payment File up front delivering message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continuing through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

Our in-house QuickBooks payments experts are standing ready to help you make an informed decision to move your company's payment processing forward.

Pricing with our Request For Payment Professionals

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Create Multiple Templates. Payer/Customer Routing Transit and Deposit Account Number may be required to import with your bank. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.